Build-to-Rent (BTR) helps drive economic productivity, and with the right government intervention, could not only play a key role in Australia’s economic recovery from COVID-19 but also ensure the future liveability and resilience of our cities.

In November 2019, Urbis and Allens collaborated on an advocacy piece: Build-to-Rent: Unlocking the Future Liveability of Australian Cities. At the time, Australia’s population was skyrocketing, along with property prices. These trends directed a larger portion of Australians in search of affordable high-quality rental options, close to work and play. 12 months on, and the world in which we live today has changed dramatically. COVID-19 has impacted everyone differently, but the one constant is that we must take this opportunity to future proof our cities, ensuring economic and social resilience as we recover from the greatest economic event of our lifetime.

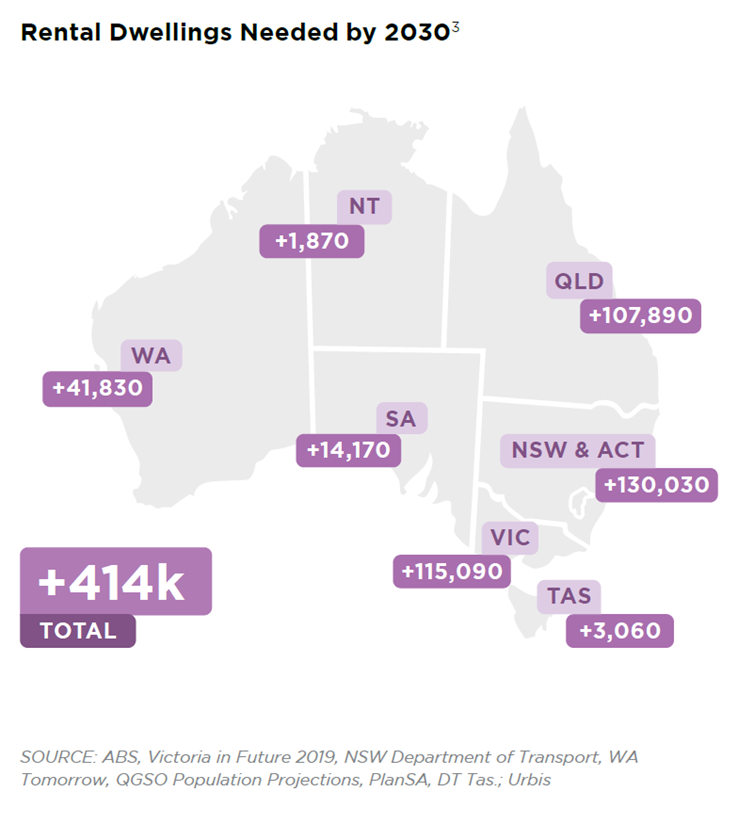

Our latest report outlines the simple steps that will both accelerate the BTR sector and help safeguard a sizeable portion of the 750,000 jobs that currently rely on housing construction in Australia. By fast tracking investment in the BTR sector, government can simultaneously enact a quick lever for economic stimulus, whilst addressing the current housing supply gap.