The transformation opportunity in retail property

In the face of cost-of-living pressures, e-commerce growth, concerns over shopping centre performance in the pre-COVID era of restrained spending and elevated redemption requests, the retail property sector has been under scrutiny.

Yet, signs of a resurgence are emerging. The retail sector’s proven resilience, rebasing of rents and a halt in new competition driven by increased construction costs all suggest a shift in investor sentiment.

Urbis has released the Urbis Shopping Centre Benchmarks for 2024, now in their 33rd year, which include data from over 560 shopping centres, representing approximately 20 percent of the total Australian retail market. The Benchmarks are a uniquely powerful tool to analyse performance at the individual centre level, including various merchant types, but they also provide a compelling snapshot of the performance of the shopping centre industry.

Building on 2023 successes

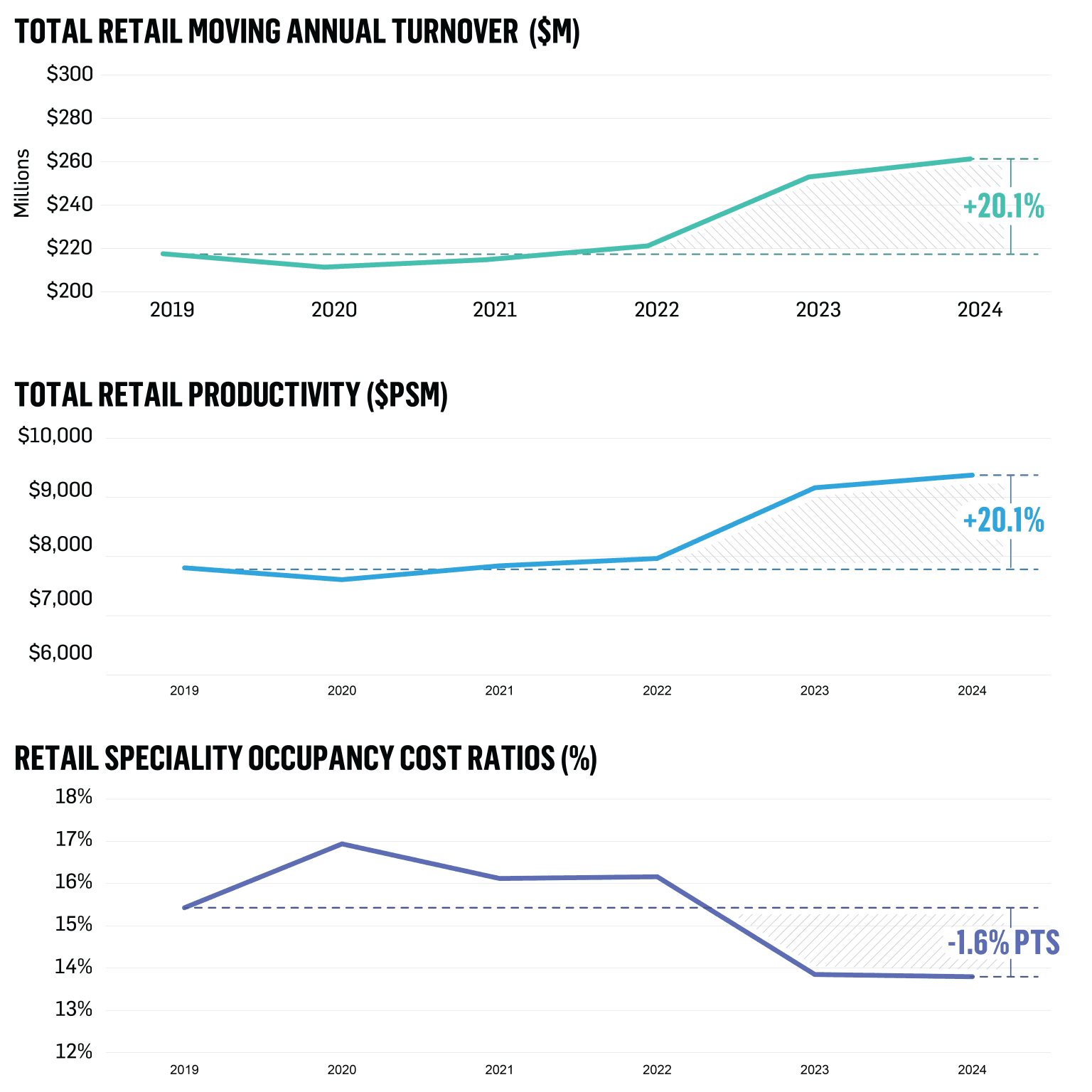

Reflecting on the 2023 Benchmarks, shopping centres demonstrated a robust rebound from the impact of COVID-19, with moving annual turnover (MAT), productivity and rent per square metre all surpassing pre-pandemic levels. If 2023 was the year shopping centres broke from their COVID-era shackles, 2024 was a year of consolidation.

With severe cost-of-living pressures, the 12 months to June 2024 marked one of the most challenging periods for retail trade, with real per capita retail spending falling by 3.4%. In this context, the performance of shopping centres is quite remarkable.

Outperforming the broader retail market

Population growth and retail price inflation combined to lift total nominal retail trade by 1.8% in the year to June 2024. The average shopping centre increased its MAT by over 3% while productivity grew by 2.3%, clearly outperforming the total retail market.

All centre types, except regional centres, saw MAT and productivity improve. With their greater exposure to discretionary categories, regional centre MAT was flat. However, this centre type had already seen MAT growth of 19% in 2023, so the significant gains made were maintained in 2024.

CBD centres built upon their post-pandemic rebound, with turnover soaring 49% in 2023 and adding another 4% in 2024. Sub-regionals and neighbourhood centres continued their steady performance, with MAT rising by 8% and 2.5% respectively.

Occupancy cost ratios remain at historical lows

Another finding from the Urbis 2024 Benchmarks was the continuation of the 2023 trend of particularly low occupancy cost ratios (OCRs) through 2024. As MAT and productivity rebounded strongly following the pandemic, rents have not kept pace. On average across all centre types, specialty OCRs remained at 13.8%, well below pre-COVID trends.

Sub-regional centres were the only centre type to experience an increase in OCRs year on year, with specialty rents now accounting for 12.6% of turnover, up from 12.4% last year.

CBD centres saw the largest declines, with specialty OCRs at 16.4% in 2024, down from 17.6% in 2023. CBD centres were the only centre type to see a decline in rent per square metre.

Leveraging robust recent turnover growth to generate rental uplift presents a clear opportunity for landlords and points to income upside potential in the short to medium-term.

Strong fundamentals and supply-side advantages

Australian retail property enjoys strong fundamentals, driven by demand-side factors like high population growth. However, Australian centres also benefit from significant supply-side advantages. Recent increases in building costs have severely reduced construction activity, both for new centres and expansions of existing centres. In fact, retail gross leasable area (GLA) for the average shopping centre has not increased since 2019.

From a longer-term perspective, Australia’s planning regime prioritises an organised retail hierarchy with shopping centres, in particular larger-scale centres, located in strategically logical geographic catchments. David Hoy, Group Director at Urbis, notes, “when looked at through a macro urban planning lens, metropolitan planning remains very much based on concentrating retail activity in planned centres and precincts, more often than not leveraging significant public transport infrastructure.

David continues, “Centre based planning settings continue to evolve, increasingly supporting the delivery of well-designed higher density and integrated mixed used precincts each with their own unique sense of place, providing a point of difference with significant levels of shopper, visitor and resident amenity. Put simply, strong centres are a catalyst for great urban spaces and places.”

Beware pitfalls for investors

Australia’s state-based regulatory environment can present complexities for retail property investors. The multi-layered tax regime means any investment must be considered on a state-by-state basis.

Hamish McKnight, Director at Urbis, shares, “Tax policies vary considerably by state and can be subject to change. For instance, recent variations to tax regimes in Queensland and Victoria have a particular impact on foreign buyers. It is critical for investors to understand how these different policy settings can impact feasibility and the attractiveness of different assets and asset classes in various parts of Australia.”

Growing investor appetite for Australian retail Property

Strong performance and supply-side advantages have sparked renewed investor interest in retail property over the last six months. Despite interest rate fluctuations, there is a prevailing view that cap rate compression is likely. Compared to other asset classes, retail property is seen as offering greater rental upside and a more favourable competitive environment. The number of parties expressing interest in on-market retail properties has risen, indicating strong bidder depth.

Despite a constrained trading environment, Australian shopping centres have displayed impressive durability, consolidating performance improvements made in 2023. This resilience, combined with historically low OCRs and a limited supply pipeline, has seen investors re-evaluate Australian retail property.

The power of ‘peer’ benchmarks

The Urbis Benchmarks contextualise a centre’s performance against others in similar asset classes, providing insights into optimising tenancy mix, turnover or rents, and making informed decisions about purchasing or divesting properties.

Urbis’ in-house data analytics capabilities can also combine confidential benchmark data with demographic, competitive, geographic and other variables to create a more granular, hyper-relevant ‘Peer’ Benchmark of de-identified centres.

The consensus is clear: It really is retail’s time to shine.

Gain deeper insights and benchmark your shopping centres’ performance. Contact us at benchmarks@urbis.com.au to purchase your Urbis Shopping Centre Benchmarks, Bespoke Peer Group Benchmarks, or KPIs for individual categories.