Melbourne

Residential property transactions in the middle and outer rings of Melbourne grew strongly during the pandemic as buyers searched for larger properties better suited to spending more time at home. At the same time, the inner ring of Melbourne suffered a significant drop in transactions from which it is only just starting to recover.

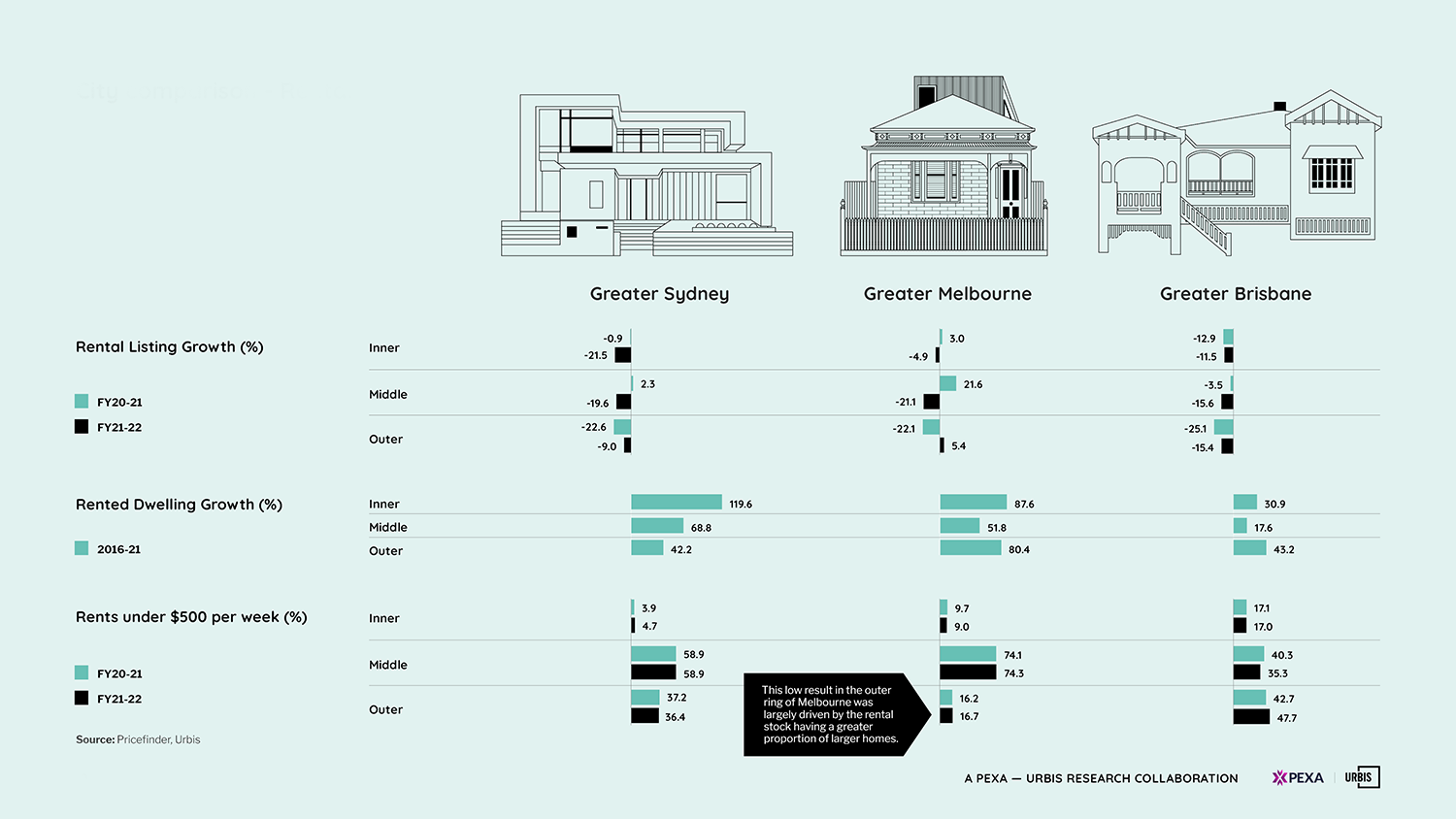

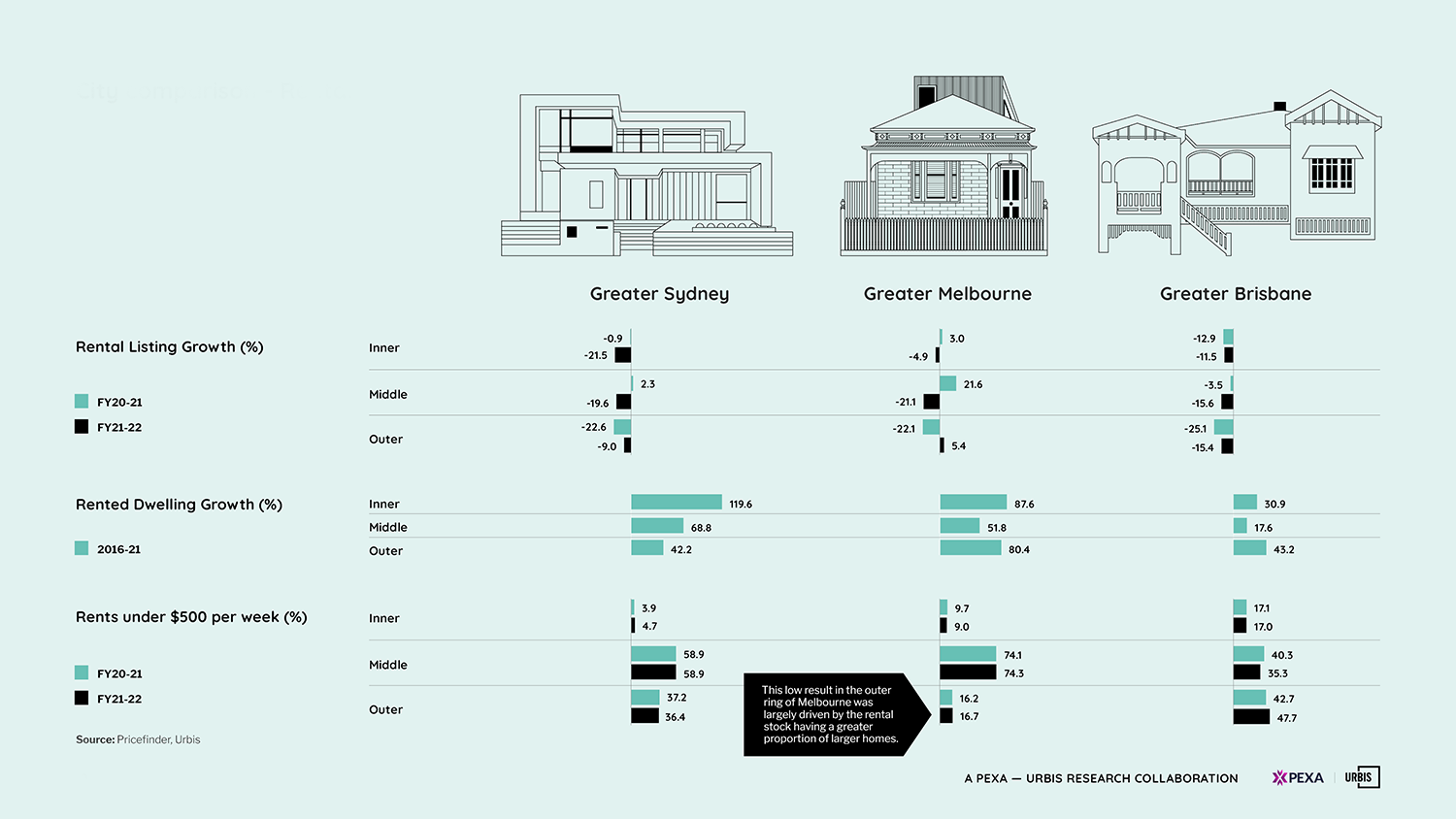

In the Melbourne rental market, the inner ring of Melbourne saw the greatest spike in listings and subsequent fall in rents over the pandemic. The rebound has now gathered pace rapidly, with listings trending at half the volume of January 2021. Rents in the outer and middle rings of Melbourne have continued to grow throughout this period, so much so that rents in the outer area have been playing catch up to rents in the middle ring.

Sydney

The outer ring of Sydney experienced a large increase in transactions in FY21 as buyers looked to escape the city during the early phase of the COVID-19 pandemic. This growth stalled in FY22 as restrictions were lifted and the inner and middle rings of Sydney proved more popular with buyers in FY22. Sydney experienced a shorter and shallower impact on rent compared to Melbourne. These impacts occurred in the inner and middle rings of Sydney, and had largely recovered by the end of 2021.

Rental growth has since accelerated further beyond pre-pandemic levels. Landlords in the outer ring of Sydney avoided negative impacts on rents during the peak pandemic impact in 2020, with rents continuing to climb into 2022. Listing volume has fallen substantially across Sydney adding the prospect of further rental price growth.

Brisbane

All regions experienced explosive growth in residential transactions in FY21, as Queensland was able to control the spread of COVID-19 and benefited from increased interstate migration. The middle ring of Brisbane was up a huge 80.3% year-on-year as the market boomed. This growth slowed in FY22 as the market softened, with the inner ring of Brisbane becoming more popular with buyers.

In contrast to Sydney and Melbourne, Brisbane did not experience the same prolonged spike in rental listings associated with COVID-19 lockdowns. As a result, rental impact was limited in extent and duration in 2020 and rents have since accelerated across the inner, middle and outer rings of Brisbane in line with declining listing volume.

City comparison: residential dwellings (click to enlarge)

City comparison: Residential sale settlements (click to enlarge)

City comparison: rental (click to enlarge)