In the latest edition of Self-Storage Association Australia’s (SSAA) magazine, Insider, Urbis Senior Valuer Tim Creighton outlines the development of new initiatives to benefit the self-storage industry.

The investment profile of self-storage continues to evolve following the December 2013 listing of National Storage REIT (NSR) on the Australian Stock Exchange (ASX).

To stand alongside other mainstream asset classes, the self-storage industry will increasingly be challenged to provide greater market transparency and elevate the production of meaningful professional data.

Presenting at the 2017 SSAA Owners Summit, Tim along with Urbis Director David Blackwell, shared with the audience two Urbis initiatives set to positively impact the self-storage industry. Considered significant developments in the progression of self-storage as a mainstream asset class, the two programs unveiled are:

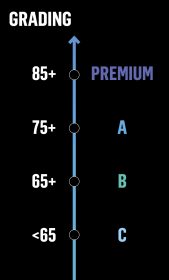

- Urbis Self-Storage Grading System (Grading System)

- Urbis Self-Storage Supply Tracker (Supply Tracker)