Getting to 1.2 million: NSW sets agenda to meet its target

When reviewed against the history of the Commonwealth’s involvement in housing policy, it is fair to say we are in a golden age of intervention and strategy setting.

However, with greater Commonwealth involvement, we also see greater complexity in the housing system of Australia. Will this greater complexity be worth it?

We think so.

The past year has seen several significant developments:

- In August 2023, the Commonwealth and states and territories agreed to target the construction of 1.2 million new, well-located homes over 5 years from mid-2024 to mid-2029 as part of the National Housing Accord.

- The first round of the Housing Australia Future Fund Facility (HAFFF) and National Housing Accord Facility (NHAF) was released. We are expecting funding decisions to be made for many of our clients in the third quarter of 2024.

- The National Cabinet also agreed to a National Planning Reform Blueprint which, if it is going to be accurately measured, will require an update to how each State uses estimates, projections, and data sources. As Urbis works across Australia, we know all too well how the different definitions and measures of tracking can skew data when comparing housing supply across the country.

- The Department of Social Services released the National Housing and Homelessness Prospective Plan. Read Urbis’ submission here: A 'wicked problem': practical steps towards improving Australian housing supply

- On 27 December 2023, the Federal Government established the National Housing Supply and Affordability Council (NHSAC) to build an evidence base, research into matters affecting the demand for, supply of, and affordability of housing. Each financial year NHSAC must report to the Federal Minister for Housing on the research into housing supply and affordability undertaken by the Council in that year.

- On 3 May 2024, the NHSAC released their first annual report The State of the Housing System 2024. The report offers a holistic view of the housing system, its inputs, and the evolution of policy over time. Importantly, NHSAC are modelling projections based on the supply of new market housing (gross) after deducting demolitions (‘net new market supply’). To arrive at the net new market supply, NHSAC apply a discount rate of approximately 3.757% to account for 2021 Census data level of demolitions.

- In their first annual report, NHSAC reported a significant shortfall of new supply relative to new demand of around 37,000 dwellings in the 2023–24 financial year. As such, the task of meeting the National Housing Accord target is already an uphill battle.

- In May 2024 the Federal Government released for consultation a draft National Urban Policy, an outline of a series of objectives and principles to guide the evolution of Australian Cities. The consultation period is open until 4 July 2024.

With each of the above initiatives, it is practically up to the states and territories, and local governments, to facilitate the outcomes on the ground. It is predominantly up to the private sector to deliver the housing that is required to meet these targets.

The NSW housing agenda

In NSW, incentives to deliver more housing by the private sector have been focused on three primary policies:

- Transport Oriented Development (TOD) program – including significant rezoning around 8 ‘accelerated’ stations, and more mid-rise and affordable housing in a phased delivery across 37 stations.

- The Low- and Mid-Rise Housing Policy which has been announced and exhibited, and notably ‘refined’ in May 2024 to reduce the extent of area where the policy will apply. Specifically, the policy has been refined to exclude the E1 Local Centre, E2 Commercial Centre, MU1 Mixed Use, and SP5 Metropolitan Centre zones, and is significantly reduced in the R1 General Residential zone.

- The finalised Infill Affordable Housing Policy, providing density uplift for projects with a minimum 10% affordable housing component. We are currently preparing many State Significant Development Applications (SSDAs) under this finalised policy to increase housing supply.

- Other bespoke changes have also been progressed to improve the delivery of more social and affordable housing, such as the introduction last week of a new, simplified rezoning pathway for Homes NSW and Landcom (Rezoning pathway for social and affordable housing | Planning (nsw.gov.au).

However, last week the big announcement was that the NSW Government released housing targets for 43 Greater Sydney Councils and Regional NSW to contribute 377,000 of the National Housing Accord.

NSW housing targets

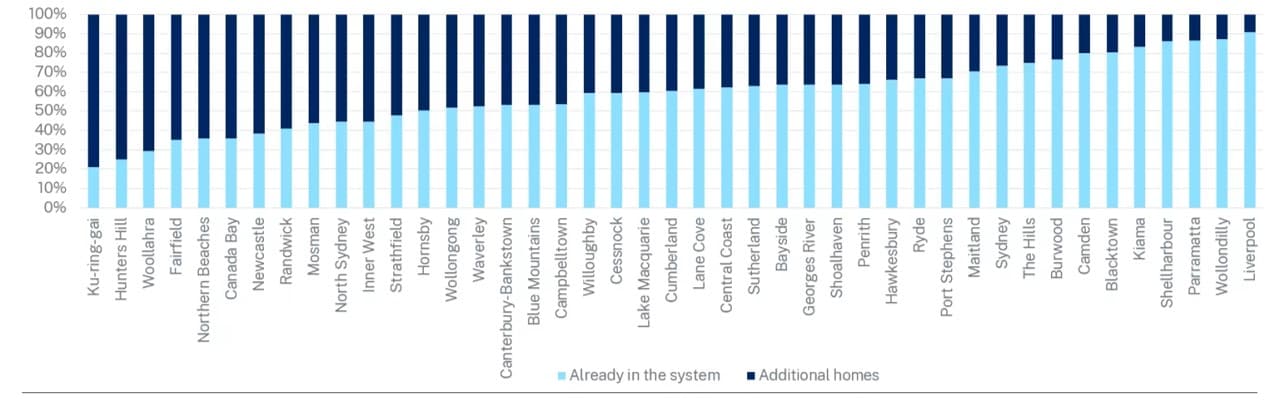

The targets include regional NSW and all 43 LGAs in the Six Cities Region, with the 33 LGAs in Greater Sydney required to deliver 263,540 new dwellings. To achieve these targets, Greater Sydney LGAs will need to collectively increase gross completions by approximately 69% compared to the last 5 years (from 150,300 net completions FY18-23, adjusted to approximately 156,200 gross completions).

As expected, the targets highlight the significant challenges facing not only the government but the development, construction and planning industries across the state.

What’s in?

- They are measured on dwelling gross completions and not development approvals. We are pleased to see completions maintained as the target to focus on what is important, getting roofs over heads.

- DPHI will be tracking results based on ABS quarterly Building Activity Australia data series. This is a gross measure and as such does not allow for easy comparison between previously reported completions or targets without adjustment. In the long term however, this will allow for easier comparison between targets and completions across state lines.

- Targets include both ‘planned’ new homes and ‘projected’ new homes.

- Planned new homes are either under construction, approved but not commenced, under assessment, or ‘planned for delivery’ by June 2029.

- Projected new homes include the theoretical capacity under existing and proposed planning controls and zonings, tempered by industry capacity constraints, bushfire and flood-risk impacts on dwelling potential in some LGAs, and the program constraints such as construction timeframes.

- The ‘Low- and Mid-Rise Housing Policy Refinement Paper’ which articulates refinements to this previously announced policy, appear to have informed these new housing targets, indicating in some instances which town centres are likely eligible for the uplift due to be finalised in mid-2024.

- 82% of the targets will be from in-fill development compared to 18% of greenfield development, representing a significant shift from existing development patterns and a far higher proportion of infill housing targets than other Australian jurisdictions such as Melbourne. This will lead to greater disruption to existing communities and the urban form than we have seen even at the peak of housing delivery in 2017.

- To incentivise councils, $200 million in grants have been announced for those who meet and beat these targets.

What's out?

- The targets do not include non-strata housing types including student accommodation, boarding houses or aged care facilities. The increase in delivery of these housing types will remain important to ensure housing is fit-for purpose and meets the diverse needs of our community.

- The National Housing Accord requires at least 3,100 new affordable homes in NSW but these targets do not set affordable housing targets per LGA.

- The targets do not include 6-10 year targets, which will need to be included in the Region or District Plans.

- There are no penalties for councils if these targets are not met.

West to east trends

While it has been suggested that there has been a shift in housing targets from ‘west to east’, the distribution of housing targets is quite similar to the 2016 District Plans, as shown in the table below.

|

Housing targets breakdown by District |

|||

|

District Plan Target |

GSC Targets |

2024 Housing Targets |

|

|

2016-2021 |

2021-2026 |

2024-2029 |

|

|

Eastern Harbour City |

41% |

38% |

41% |

|

Central River City |

38% |

39% |

37% |

|

Western Parkland City |

21% |

23% |

22% |

However, when comparing planned and projected homes, most Eastern Harbour City Councils have a greater proportion of their supply from new projected homes rather than planned homes, reflecting a larger perception of change for these areas. This further emphasises the point above regarding the greatest change being felt in the Eastern Harbour City from recent net supply.

Given there is required to be significant increases in completions from the last 5 years, it is critical that the policy settings and implementation process dramatically improves.

While Councils cannot ultimately control the construction of new housing, the financial incentives announced will likely be provided to councils based on development approvals. It is not yet clear what ‘approval’ targets will be set for councils to be eligible, with incentive criteria to be released in the second half of 2024.

Challenges ahead

The latest state policy initiatives are a positive step, but we are already seeing challenges that could hinder the achievement of these targets within the timeframe:

- Previous housing targets were measured in ‘net completions’. So, if you knock down and rebuild a house, this will now count as 1 new dwelling towards the housing targets (even though there are no new houses added to the supply). This measure will likely skew the data, even if secondary dwellings are now able to be captured in new dwelling supply (previously this was not possible, as it was measured on Sydney Water new connections).

- For SSD under the Infill Affordable Housing policy – there has yet to be a streamlining of assessment deliverables and processes which are more onerous than a local or regional DA would have ordinarily required, and thus stretching out approval timelines. We commend DPHI for looking at improving these processes and look to see improvements in the coming months.

- The recently rezoned ‘tier 2’ TOD sites have created a complex relationship between the new built form controls and with existing council Development Control Plan (DCP) provisions which have obviously not contemplated the change. As DCPs remain matters for consideration this instantly heightens planning approval risk and is likely to result in lower apartment yields that originally forecast to meet these dwelling targets.

- The winding back of the Low- and Mid-Rise Housing policy application to exclude large areas of R1 General Residential zoned land and exclude the application to the E1 Local Centre zone and MU1 Mixed Use zones where shop-top housing is already permissible is a missed opportunity and will likely reduce the number of feasible development sites benefiting from this policy.

Navigating NSW’s housing challenges together

If NSW is going to deliver its share of the National Housing Accord targets, we urge the State Government to continue listening to and engaging with industry to ensure that policy settings and implementation pathways do not create roadblocks for the delivery of housing to meet critical needs.

While the new housing targets set by the DPHI present a significant challenge for both the government and the private sector, they also offer a crucial opportunity to address the housing needs of NSW. Success will depend heavily on effective policy settings, streamlined approval processes and continued collaboration between government and industry.

As we navigate these changes and challenges together, our team of experts at Urbis is ready to guide you through every step of the process. We’re committed to helping you understand and adapt to these new housing targets and policies. Don’t hesitate to reach out to us for more information, insights, and tailored advice. Contact us today to learn more.