Urbis Reports on Top Trends for the SEQ Greenfield Market in 2015

The Urbis South East Queensland (SEQ) Greenfield Report will be a half-yearly publication, providing research and insight into the Greenfield land market within the wider SEQ. The report will highlight Urbis expertise across the residential spectrum, providing a publication that monitors all active pending and future land supply within the Local Government Areas (LGA) that make up South East Queensland.

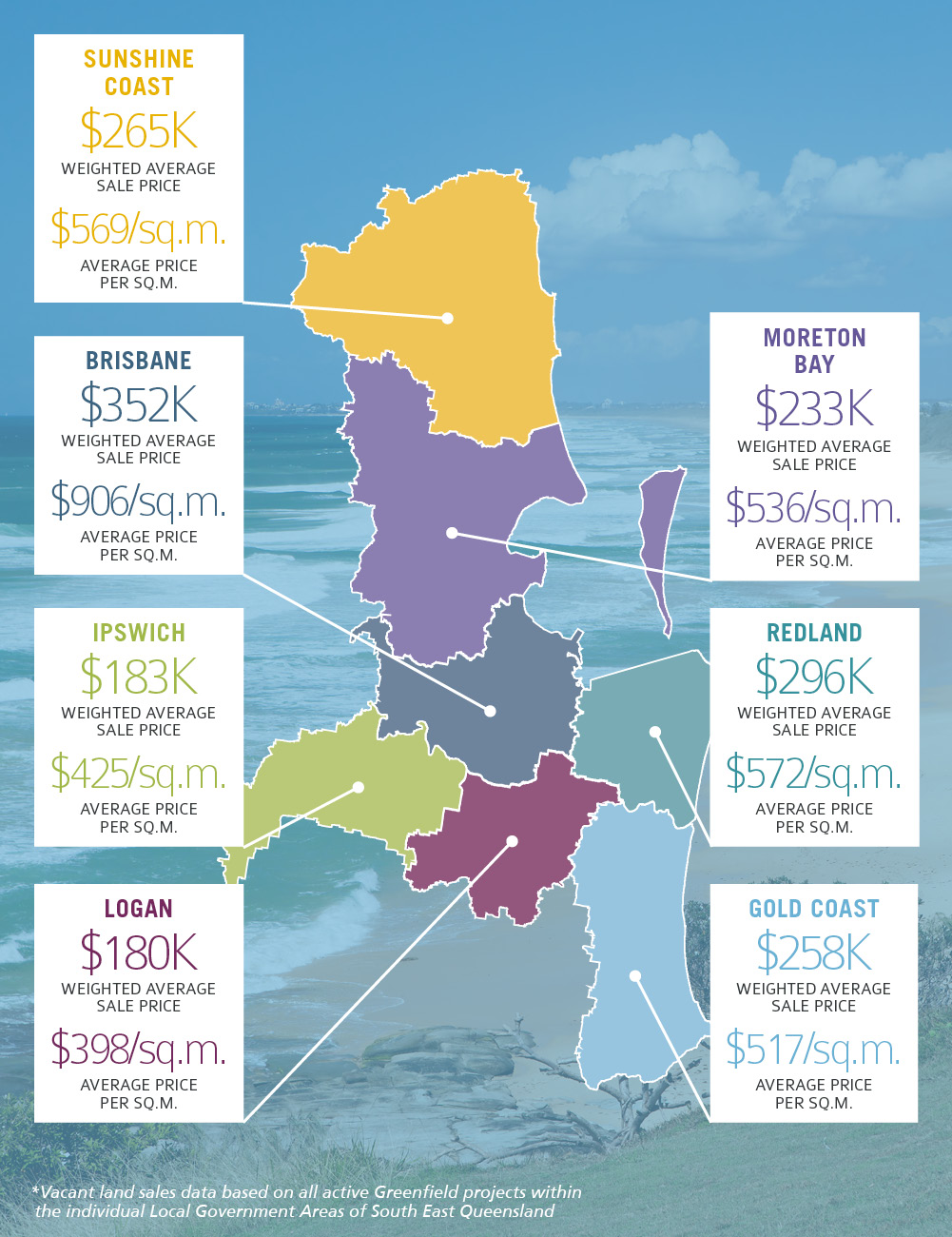

Urbis will identify and monitor Greenfield projects over 100 lots in size to analyse and report on the active Greenfield market in South East Queensland. The LGA’s included in the analysis are Sunshine Coast, Moreton Bay, Brisbane, Redland, Ipswich, Logan and Gold Coast.

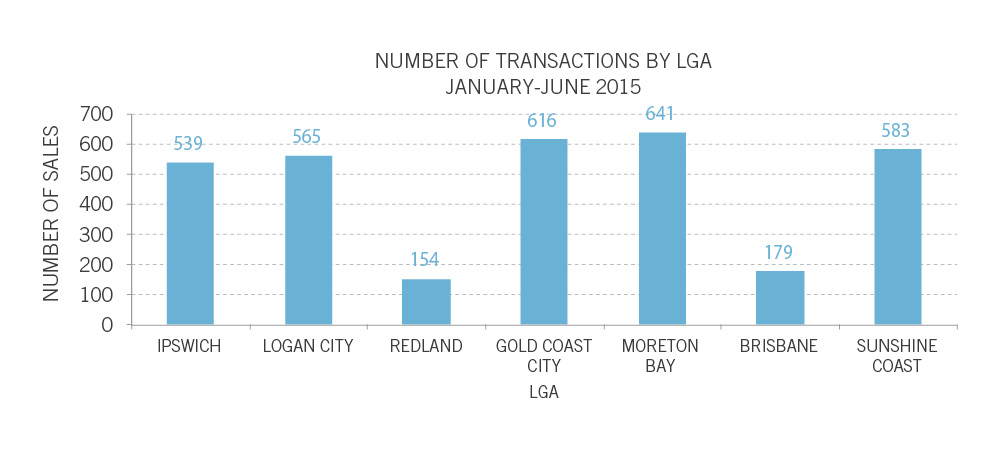

119 active Greenfield projects were monitored in South East Queensland over the six month period ending June 2015 (2015 H1), equating to around 3,300 vacant land settlements. These results were solid and continued the re-emergence of the Greenfield land market throughout 2014.

The Moreton Bay and Gold Coast LGA’s registered the greatest sales over the six month period ending June 2015 recording 641 and 616 vacant land settlements respectively. With regards to pricing however, both the Ipswich and Logan LGA’s were the most affordable markets, with weighted average sale prices below $200,000. This finding was also reflected in dollar per square metre rates, with average prices per square metre at $398 and 425 for the Logan and Ipswich LGA’s respectively.

Other notable trends in the 6 months ending June 2015 included:

- Affordability reigns supreme in the Ipswich and Logan’ markets, with an increased volume of vacant land sales less than 450sq.m

- Slightly larger lots on the increase in Redland and the Gold Coast, with increases of 10% recorded in sales between 450 and 550sq.m

- Generally however, vacant land sales greater than 550sq.m recorded declines across the majority of SEQ areas.

- Increasing competition, affordability and limited price escalation has added to the reduction in overall lot size in the past 6 months, driving the majority of SEQ to increased average rates per square metre. This was particularly prominent within the active LGA’s of the Gold Coast (7.0%), Moreton Bay (5.75%) and Logan (5.7%) registering the highest increase per square metre over the 6 month period ending June 2015.

- Regions with limited Greenfield supply including Brisbane and Redland LGA registered the lowest number of transactions, with these two areas recording the highest dollar per square metre rates across the SEQ.

Generally throughout the SEQ, the six month period ending June 2015 saw the Greenfield market register strong sales, with this transaction activity expected to continue as owner-occupier and investor demand for Greenfield land gains revised momentum.

For more information on how Urbis can help you, please don’t hesitate to contact one of our Greenfield Economics and Market Research specialists below.

For more information on how Urbis can help you, please don’t hesitate to contact one of our Greenfield Economics and Market Research specialists below.