- Home

-

Categories

Table of Contents

- Share

- Search

|

2013 has seen increased levels of demand for quality stock and a firming of yields, particularly for markets with good fundamentals.

Urbis anticipates continued strong investor demand in the year ahead. Active management of retail assets has protected income streams against the head wind of impact from online retail and generally weaker conditions experienced in Australia.

However, there are still issues to be combated in the retail sector with some local tenant categories still struggling with lower than optimum retailing conditions.

Providing further support for retail property owners, the PCA IPD Investment Index shows Australian Retail near the top of the index with a total return of 9.2% over the last 3 years.

Prime quality assets have exhibited yield compression throughout the second half of 2013, however Urbis anticipates no further yield compression to occur throughout 2014. Any further yield firming is considered unlikely for prime quality centres.

A shift in investor sentiment towards secondary assets is being exhibited and this has resulted in increased levels of activity. The secondary market is anticipated to experience further yield compression throughout 2014.

Poor quality assets are expected to be subject to price discounting by investors, reflecting the inherent risks associated with poor quality assets.

In terms of the availability of debt, recent interest rate reductions by the RBA which now see the official cash rate at 2.5%, together with continued confidence and stable asset prices has meant that debt for real estate development and investment has become more available. Anecdotally we understand that cost of debt margins have reduced significantly and importantly banks are starting to relax lending criteria in appropriate cases.

Figure 1 shows Urbis’ view of Shopping Centre Investment Hurdle Rates as at January 2014.

The Australian economy continues to grow steadily, albeit at a slower rate than it has over the last two decades as it descends from the peaks of the mining boom. Real growth is anticipated to be 3.0% in FY 2014 and 3.3% in FY 2015. Whilst slower than previous rates of expansion, this remains a strong outcome by global standards.

The PCA IPD Investment Performance Index shows Australian retail property delivering a return of 9.2% over the 3 years to September 2013 (Figure 2). At a sub-sector level, Australian Super and Major Regional Retail centres recorded a total return of 9.4% over the 3 years to September 2013, whilst the highest total return within the retail category of 9.6% over the 3 years to September 2013 applied to the Australian Sub Regional Retail sub-sector level. The index shows Australian Office and Industrial property delivering returns of 9.8% and 9.9% respectively over the 3 years to September 2013.

At the time of reporting, Australia from an economic perspective has been experiencing relatively favorable conditions. Individual drivers contribute to the performance of shopping centres in Australia and are inclusive of the relatively stable labor market, with unemployment at a national level continuing on a stable footing.

Retailers are still finding trading conditions difficult albeit there are some signs of improvement in some sectors. Over recent months there has been a significant increase in activity in the commercial real estate sector which has been largely supported by:

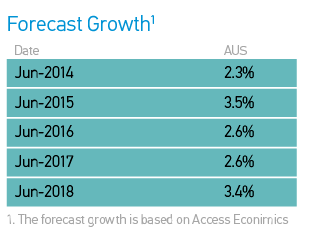

Figure 3 demonstrates that Australian Retail Sales Growth was 2.00% for the quarter ending September 2013, the rate of growth falling from 3.00% for the quarter ending September 2012. Looking forward, Urbis forecasts Australian Retail Sales Growth of between 2.5% to 3.5% over the five years to June 2018.

Regional Shopping Centre transaction levels were high throughout 2013, with a total of eight Regional transactions recorded throughout the year. The notion of part share transactions was prevalent with six of the eight transactions acquired as part shares.

A key transaction for the top end of the retail sector is Karrinyup Shopping Centre (WA). The Karrinyup Shopping Centre Trust (UniSuper 66% and Westfield 33%) commenced a closed bid process which resulted in UniSuper acquiring Westfield’s remaining interest of the centre at a price of $246.67m. The price equated to a 100% interest value of $752m at an equivalent market yield of 5.40% and an internal rate of return of 8.65%. The price confirmed the continued institutional demand for prime, dominant regional shopping centres that have further development potential. We provide our analysis of Karrinyup Shopping Centre overleaf.

GPT sold a 50% interest in Erina Fair Shopping Centre (NSW) in May 2013. Third party information has revealed that the 50% interest was purchased for $397.1m reportedly by South Korea’s National Pension Service with Australian Prime Property Fund – Retail retaining ownership of the remaining 50% interest. The transaction reflected an equivalent market yield of between 6.00% – 6.25% and an internal rate of return in the order of approximately 8.75%.

The transaction of Greensborough Plaza Shopping Centre (VIC) for a purchase price of $360m reflected a reported equivalent market yield in the vicinity of 7.25%. The three level Regional Shopping Centre was purchased by private equity group Blackstone in June 2013 from Australian Prime Property Fund Retail and Lend Lease Funds Management.

Also of note are the 50% interest transactions sold by Centro prior to their rebranding to Federation Centres of Centro Colonnades, Centro Galleria and Centro The Glen to The Perron Group based in WA.

The sales of Karrinyup and Erina Fair Shopping Centres provide a clear benchmark for current market pricing of prime regional shopping centres and exhibit a bias towards capitalisation rate compression.

Throughout 2013 the most notable improvement in investment activity and pricing was in the sub regional shopping centre category. A major shift in investor sentiment towards sub regional shopping centre investment has been exhibited and this has increased activity, resulting in a tightening of pricing metrics for good quality assets.

A number of transactions occurring throughout the second half of 2013 reflected capitalisation rates either side of 7.00%. A further key highlight for the sub regional assets in 2013 has been the re-emergence of main stream listed investors into the market such as CFSGAM, LaSalle Investment Management, Challenger, Charter Hall, ISPT and others.

The transaction of Bunbury Shopping Centre (WA) for a purchase price of $143.27m (including sundry properties) reflected an equivalent market yield of 6.76% and internal rate of return of 8.95% (analysis based on Shopping Centre component only). The centre was purchased by Challenger Life Company Limited and comprises further expansion potential. Our analysis of Bunbury Shopping Centre is provided in the pages that follow.

ISPT sold Toowoomba Kmart Plaza (QLD) to a local Queensland investor (the McConaghy Family) in August 2013. The purchase price of $55m reflected an equivalent market yield of 7.06% reflecting the prime sub regional nature of the asset.

There have also been a number of poor quality centres transact over the course of the year that have resulted in significantly softer pricing metrics, including:

Lend Lease sold Pakenham Place (VIC) to LaSalle Investment Management for $38.9m reflecting an equivalent market yield of 9.0%.The centre comprises three main retail buildings and a number of peripheral properties. The major tenants (Target, Coles and Woolworths) were all trading below Urbis benchmarks, whilst specialty tenant rents were considered below market levels as the vendor had many ‘holding over’ to facilitate a potential redevelopment. Our analysis of Pakenham Place is provided in the pages that follow.

The transaction of ISPT’s Fairfield Forum (NSW) for a purchase price of $32m reflected an equivalent market yield of 9.40%. The centre is anchored by Coles and Kmart with a relatively poor tenancy mix including a number of discount variety and other budget orientated retailers that were trading well below market benchmark levels.

|

|

| BUNBURY ANALYSIS | PAKENHAM ANALYSIS |

Similar to the sub regional sector, the neighbourhood sector has also undergone an insurgence of activity and this included both private and institutional investment.

At the institutional level, SCA Property Group has entered into an agreement to acquire a portfolio of seven neighborhood shopping centres located in Tasmania at an aggregate capitalisation rate of 8.00%. The off market transaction consists of a portfolio of centres including Claremont Plaza, Sorell Plaza, Kingston Plaza, Greenpoint Plaza, Shoreline Plaza, New Town Plaza and Riverside Shopping Centre, all anchored by Coles or Woolworths supermarkets with New Town Plaza also containing a Kmart DDS.

Further to this, the other significant portfolio transaction has been the ISPT acquisition of a national portfolio from Coles Supermarkets. ISPT purchased a 50% interest in a range of assets around Australia with the majority being in regional and provincial locations, with the exhibited yield range in the order of 7.50% to 9.00%.

There have also been a number of individual transactions which have exhibited yields ranging from 7.45% to 8.50% and a further range of transactions above this range for secondary and poorer quality assets and this is representative of accurate pricing discounts for secondary and underperforming assets.

|

Matthew Cleary National Director Valuation & Advisory 03 8663 4829 mcleary@urbis.com.au |

|

Estelle Fraser Valuer Valuation & Advisory 03 8663 4843 efraser@urbis.com.au |

|

Clinton Ostwald Director Economics & Market Research 02 8233 9918 costwald@urbis.com.au |

|

Russell McKinnon Director Valuation & Advisory 02 8233 7608 rmckinnon@urbis.com.au |

|

Bobby Dunimagloski Director Valuation & Advisory 02 8233 7605 bdunimagloski@urbis.com.au |

|

Ivan Hill Director Valuation & Advisory 07 3007 3815 ihill@urbis.com.au |

|

Marcus Conabere Director Valuation & Advisory 03 8663 4882 mconabere@urbis.com.au |